This will help us to remind you to process your payrolls on time. Pay Schedule is the combination of two things - your pay frequency, which is how often you pay your employees and your pay date. If your business follows a different tax payment frequency, write to us at and we’ll enable it for you.Ĭlick Save & Continue once you’ve entered the tax information. Tax Payment Frequency tells us how often you deposit your Tax Deducted at Source (TDS) to the Income Tax Department.

You can get this number from the Income Tax Office or by logging into your online Income Tax Account and navigating to the My Profile section.

#Zoho invoice setting up portal already setup code

All businesses who deduct or collect tax must have a TAN, quoting it in their TDS documents.ĪO Code (Assessing Officer Code) is a combination of Area Code, AO Type, Range Code and AO Number. Tax Deduction and Collection Account Number (TAN) is a unique 10-digit alpha numeric code whose primary purpose is deduction or collection of tax. Any corporate organization doing business in India requires a PAN card whether it is registered in India or abroad. These details will be displayed in the Form 16 we generate for your employees.Ī Permanent Account Number (PAN) card is a vital document for any taxpayer. On this page, you need to enter your tax details such as your Personal Account Number (PAN), Tax Deduction and Collection Account Number (TAN), TDS Circle / AO Code and Tax Deduction Frequency.

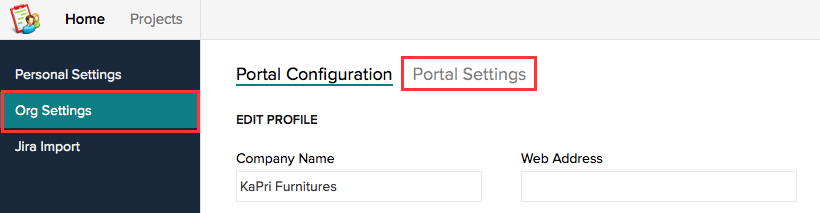

If you’ve been running your payroll already, you need to record/import all the previous payments you’ve made to your employees before you run your first payroll using Zoho Payroll. Choose whether you’ve already run payroll for this year or you’re running your first payroll of the year with Zoho Payroll.If your business operates from multiple locations, you can add them by going to Settings > Work Locations. This address will be reflected across all your Zoho Finance applications and it will be your primary work location in Zoho Payroll. Enter your Organization Name, Business Location and Industry.If you already have one, log into your existing Zoho account. To get started, go to the signup page and create a Zoho account. Before you can start processing pay runs using Zoho Payroll, you need to set up your organization, which is a simple and breezy five step process.

0 kommentar(er)

0 kommentar(er)